27 rows Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at. Employees who file for exemption from federal income tax must still have Medicare taxes.

State By State Guide To Taxes On Retirees Retirement Income Income Tax Retirement

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only.

. It can also be used to help fill steps 3 and 4 of a W-4 form. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. How to Calculate Federal Tax and State Tax in Illinois in.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. This salary calculation is based on an annual salary of 4000000 when filing an annual income tax return in Illinois lets take a look at how we calculated the various payroll and incme tax deductions.

How do I calculate how much tax is taken out of my paycheck. How do I calculate how much tax is taken out of my paycheck. How much income tax do I pay in Chicago.

How much tax is deducted from my paycheck in Illinois. That makes it relatively easy to predict the income tax you will have to pay. Simply enter your pay frequency Federal and State W-4 elections and salary.

The income tax rate in Illinois is 495 after an increase from 375 in 2017. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. It is not a substitute for the advice of an accountant or other tax professional.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. TOP 5 Tips Illinois has a flat income tax of 495 which means everyones income in. Yes all lottery winnings in Illinois are subject to tax.

The calculator will do the rest. So if you elect to save 10 of your income in your companys 401 k plan 10 of your pay will. How Much Tax Does Illinois Take Out Of Your Paycheck.

Employers in Illinois must deduct 145 percent from each employees paycheck. This calculator is intended for use by US. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

On prizes worth 5000 or over 25 Federal Tax is required and all winnings above 1000 are subject to 5 State Tax. The calculation is based on the 2021 tax brackets and the new W-4 which in. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the.

Get Your Max Refund Today. According to the Illinois Department of Revenue all incomes are created equal. 0495 for tax years ending on or after.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. The income tax rate remains at 495 percent. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Click to see full answer. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

495 percent Effective for tax years ending on or after December 31 2020 the personal exemption amount is 2325. For the employee above with 1500 in weekly pay the calculation is 1500 x. A 2020 or later W4 is required for all new employees.

Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. To find out what impact a taxable tuition waiver will have on your net pay enter the waivers received year-to-date below the calculator and taxes and net pay will update accordingly. What is the Illinois tax rate for 2020.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Illinois Hourly Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For the employee above with 1500 in weekly pay the calculation is 1500 x. Illinois Salary Paycheck Calculator. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Unlike Social Security all earnings are subject to Medicare taxes. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. It is not a substitute for the advice of an accountant or other tax professional.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. No Illinois cities charge a local income tax on top of the state income tax though.

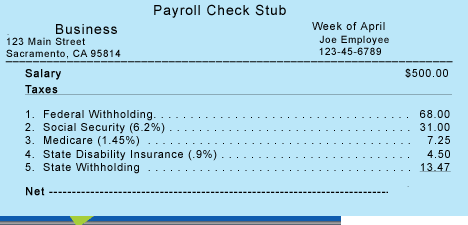

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll And Tax Deductions Smith Smith Cpas

Texas Paycheck Calculator Smartasset Com Paycheck Nevada Calculator

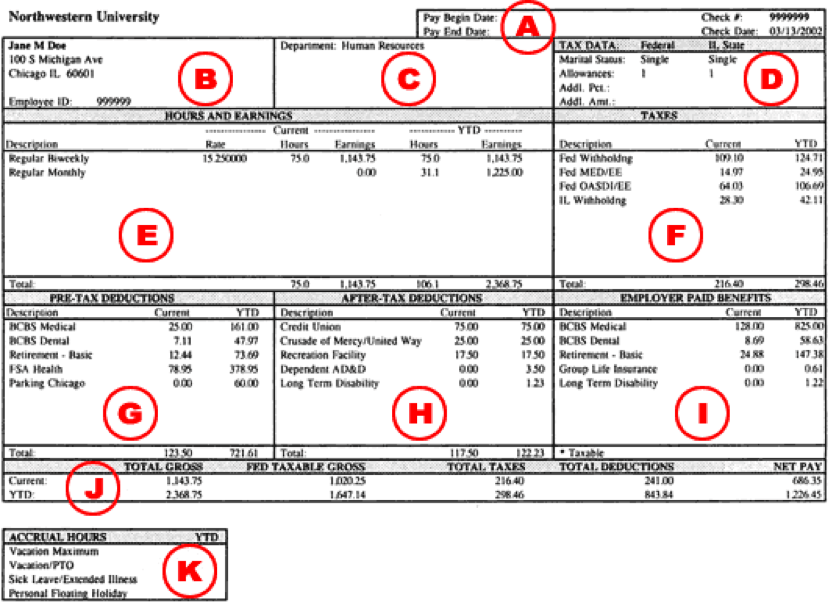

Understanding Your Paycheck Taxes Withholdings More Supermoney

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Human Resources Northwestern University

Illinois Paycheck Calculator Smartasset

Celebrating America Saves Week 7 Ways To Automate Your Savings Plan Well Retire Well How To Get Money Money Financial Financial Help

Paycheck Calculator Take Home Pay Calculator

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Finance Investing Infographic Math Review

We Make A Set Of 3 Consecutive Paycheck Stubs Pay Stubs Come Complete With Earnings Taxes Deductions And Ytd Tot Paycheck Payroll Template Payroll Checks

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Tax Withholding Calculator For W 4 Form In 2021

Illinois Paycheck Calculator Smartasset

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest